Benefits of ICICI 3-in-1 Account

Convenience

Manage your Savings, Demat and Trading Account conveniently at one place.

Availability

Available on both web and app or use our call and trade facility

Low Brokerage

Multiple brokerage plans at competitive pricing

One Click

Baskets

Exclusive curated theme based Stock and MF baskets

Stock Recommendations

Access to stock picks by

In-House research team

Margin Trading Funding

Buy upto 4X more than your funds with MTF

About ICICI 3-in-1 Account

The ICICI 3-in-1 Account gives you the convenience of opening an online Savings, Demat and Trading Account instantly...

Explore Investment Options

Hear from Our Delighted Customers

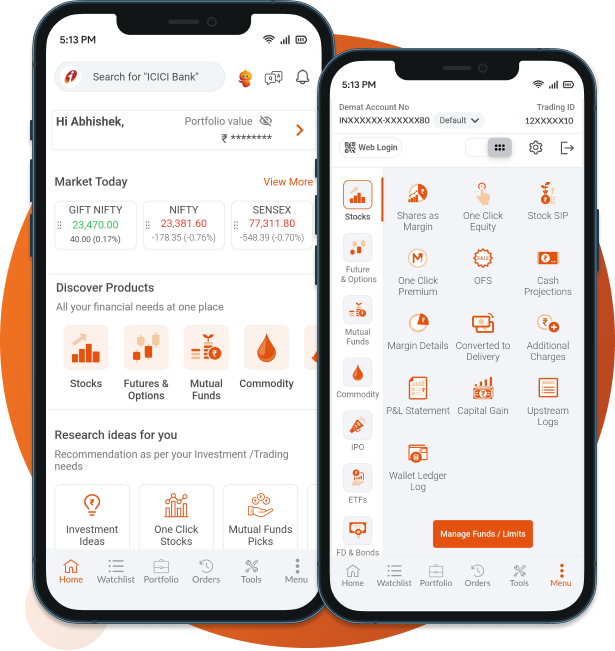

ICICI Direct All-in-one App

Designed to deliver customised wealth solutions to cater all financial needs

- ✔ Stocks, Mutual Funds, F&O, IPO, Commodity, Currency, FD & Bonds, Insurance, Global Invest

- ✔ One stop destination for Trading & Investment Ideas

- ✔ Tools that makes trading and investing easy

-

4.5

Rating on Google Play

-

4.8

Rating on App Store

-

1M+

Total

Downloads

You Got Questions? We Got Answers!

ICICI 3-in-1 Account integrates three financial services into one seamless account - a saving account, a demat account, and a trading account. This combination allows you to manage your banking, investment, and trading needs effortlessly under a single platform.

Resident individuals who are above 18 years old can open an ICICI 3-in-1 Account. Additionally, the individual must have their Aadhaar linked to their mobile number for OTP-based KYC and their original PAN for video KYC.

For Buy Orders:

- Fund Allocation: When you place a buy order, funds are allocated from your Savings Account to your Trading Account.

- Order Placement: The buy order is then sent to the exchanges.

- Trade Execution: The trade is executed once a matching sell order is received.

- Debit Process: The funds (actual transactional value) are debited from your Savings Account.

- Share Credit: The shares are automatically credited to your linked Demat Account within T+1 day from receipt of payout.

For Sell Orders:

- Share Allocation: When you place a sell order, shares are allocated from your Demat Account to your Trading Account.

- Order Placement: The sell order is then sent to the exchange.

- Trade Execution: The trade is executed once a matching buy order is received.

- Share Debit: The shares (actual sell quantity) are debited from your Demat Account.

- Fund Credit: Within T+1 day, the selling amount of shares is automatically credited to your linked Savings Account.

No, there are no charges to open an ICICI 3-in-1 Account. You can enjoy the convenience of integrated banking and trading without any additional costs.

You can buy stocks by paying an initial amount called margin amount and rest of the outstanding amount will be funded by ICICI Securities. You can sell/square off the stocks anytime or convert the stocks to delivery (CTD) before the expiry date. Interest will be charged for the funded value.

In other words, MTF is a leveraged investment product which allows you to buy shares with cash or collateral/pledged shares (Shares As Margin).

Unlike for a 'Cash buy' order, you do not have to pay the full order value in MTF order.

MTF positions will have a default validity period of 30 days and the same will be auto renewed with 30-day intervals subject to a maximum validity (Expiry) of 360 days from the date of purchase.

MTF positions will have a default validity period of 30 days and the same will be auto renewed with 30-day intervals subject to a maximum validity (Expiry) of 360 days from the date of purchase